Ps Ever Giong to Be 30 Again Reddit

Massimo Giachetti/iStock Editorial via Getty Images

AMC Entertainment (NYSE:AMC) is one of the two chief meme stocks that retail "apes" take dominated. Of course GameStop (GME) is the other most well-known meme stock. My long history as a retail stockbroker and individual retail trader dates back to 1986 when I earned my Series 7 license and worked for NYSE-member firm Oppenheimer & Co. This retail experience is foundational for my analogousness for the retail investor community.

In fact, I like to believe that I was one of the original AMC apes who posted here on i/25/22 to buy AMC at $5 per share inside of my Trader's Idea Flow service on Seeking Alpha. The weekly chart below indicates the date of my Merchandise Warning. Within 48-hours afterwards my Merchandise Warning posted, the shares of AMC soared to $25.

I issued this Trade Alert in my marketplace service at $five (IBKR)

This AMC long trading call delivered a 500% proceeds, and supports my claim to being i of the primeval AMC apes. This and the fact that as a kid I actually saw all five of the Planet of the Apes movies in one day at the local theater. Packed a bag lunch and snuck my grub into the theater under my jacket. Truthful story from a long-time apes fan.

Taking great pride in being an original AMC ape does non mean that my allegiance to the long side of the AMC trade is eternal, however. The massive 500% dilution that has been issued by AMC management since those Jan 2021 days has dramatically altered the narrative for this merchandise. These SEC filings illustrate that AMC was a weak visitor fundamentally prior to the huge amount of dilution that took place. The size of the dilution that direction issued was basically a last resort for the company to exploit its elevated share price. This gift of a capital infusion enabled AMC to successfully avoid defalcation in the most term. Yet, the share count increased massively making any lasting price appreciation for this stock far less likely.

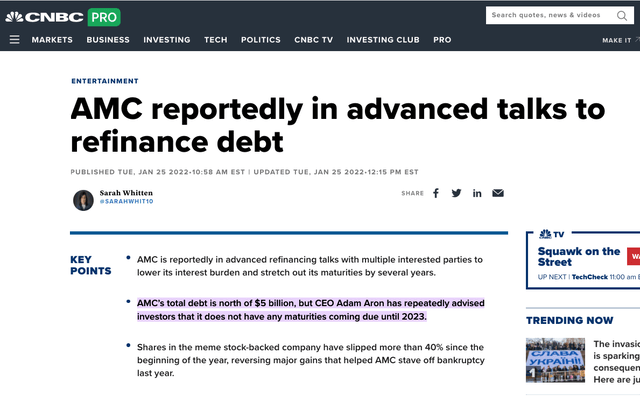

Then at that place's the huge accumulation of $5B in debt that appears to exist unsustainable in a rising interest rate surroundings. For example: If AMC'southward borrowing costs become up 2%, then debt obligations increment another $100M in almanac cash involvement on top of the $338M they pay already. That's a well-nigh 25% increase. It's unclear if AMC tin sustain this college level of interest payments. The current trajectory of interest rates could steadily rise more than 4% over the adjacent 24 months. That scenario of steadily college rates over the longer term could increase AMC's interest payments by over $200M on meridian of the $338M AMC already pays. This level of interest payments would appear unsustainable for the heavily leveraged AMC corporate finance construction.

The movie theatre was feeling pressure level from abode viewing options prior to the pandemic. The motion picture theater manufacture has been hit especially hard by COVID, and some number of movie goers may never return to the theater every bit a upshot. This industry, and AMC in particular, are challenged by very weak fundamentals. It's unclear if AMC has any good options for restructuring afterwards such a massive dilution and becoming so heavily leveraged. AMC does take near $1.5B in greenbacks on the balance sheet and may need to orchestrate something close to a phenomenon very presently to enable the visitor's survival long term.

AMC's onerous debt is problematic (CNBC)

Razor thin margins, a fading surge from the initial reopening of the economy, and a looming debt brunt that begins coming due in 2023 portend a bearish hereafter for this heavily leveraged, fully diluted visitor. Additional future dilution and increased leverage are not likely to be options for AMC as these lifelines take been maxed out by direction.

2021 saw AMC post a billion-dollar loss. The finish of twelvemonth 2021 improved with AMC posting its first EBITDA profitable quarter in Q4 in two years. This surge in motion-goer enthusiasm may have been due to consumer want to go out of the house every bit the nation's economic system reopened. If this is accurate, then this initial surge of picture-goers may fade, along with AMC revenues. This key variable for the AMC business concern model remains to exist seen.

Fifty-fifty with increased revenues, AMC all the same continues operating on margins that are unlikely to support the payment of upcoming debt payments in 2023. It'southward possible that the increasing interest rate scenario now occurring in 2022 may remain in place in 2023. Rising rates could be fatal for AMC, and may become a dagger in the fundamentally weak centre of AMC's electric current financial structure.

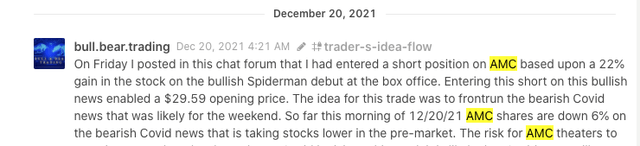

Since the AMC meme stock days of June 2021 when shares peaked at $72, the chart has been in steady refuse to a recent low of $13. During this long downtrend, there take been occasional cost spikes higher. These temporary moves higher take provided excellent short sale opportunities. The practiced news about record picture attendance for the terminal Spiderman motion-picture show in December 2021 acquired a spike in AMC share prices to $30.

Excerpt from a Trade Alarm to short AMC in my market place service (RocketChat Seeking Blastoff Marketplace)

I posted in our Trader's Idea Flow chat room this past December 2021 that AMC presented a good short sale opportunity at $thirty per share. By the end of January 2022 AMC shares traded lower to $13.forty. This was an splendid short-term gain on the AMC short. The current price spike higher in AMC shares may once once again correspond an excellent brusque sale opportunity.

For many months, the toll spikes in AMC shares accept been justifiably shorted by the market place. The current price fasten higher in AMC shares from $thirteen up to $34 today over the by two weeks now accept apes counting a greater number of bananas in their trading accounts. Apes would be wise to exit their AMC long positions and protect themselves against a likely decline in price for this stock.

AMC management has non achieved much that will move the needle meaningfully for AMC with the Hycroft Mining (HYMC) deal. Yes, Hycroft has been given a new lease on life with optimism for futurity gold and silver exploration on its 72,000 acres. Notwithstanding AMC must depend upon conducting an ongoing concatenation of such modest deals to improve its ain corporate balance sheet significantly. CEO Aron explains the model is for AMC to continually exhort investor involvement from retail to buy into the speculative ventures that AMC will be foisting upon the public. Aron is a very skillful salesperson, merely tin he continually go apes to pony up the investment capital to make these speculative deals work? Unless each of these deals brought by AMC are money makers for retail investors, then Aron may discover that his P.T. Barnum routine loses its initial appeal. Here is the recent YouTube with Aron describing this model with Cramer on CNBC.

One Fashion Out

I mentioned in the opening summary for this commodity that at that place is just i way out for AMC from its heavily diluted, over-leveraged, declining business model. AMC's best, and perhaps last, chance to attain long term survival rests with how information technology utilizes its remaining cash position on its balance sheet.

Beyond the Hycroft deal, Aron has indicated that AMC intends to go on seeking additional deals exterior of the declining moving picture industry. Candidly, it's articulate that Aron, AMC, and the stock's fans are all rolling the corporate dice together. In this context, perhaps applying the majority of the $1.5B greenbacks position towards entry into the crypto mining manufacture would be a long-shot gamble that might have a gamble of enabling AMC to survive. If Bitcoin trades in a higher place $100K in 2023, then an entry into the mining business organisation in 2022 could do good AMC'southward precarious position. Revenues could increase significantly, possibly enabling the restructuring of corporate debt.

I mention this considering AMC'due south contempo dalliance into accepting crypto payments at its motion picture theaters has preceded the purchase of an interest in a gold and silver miner. Maybe the side by side AMC deal being the company's entrance into the crypto mining space would not be a bridge as well far for AMC. This business model pivot would probable exist well-received by Apes who are the primary shareholders of AMC.

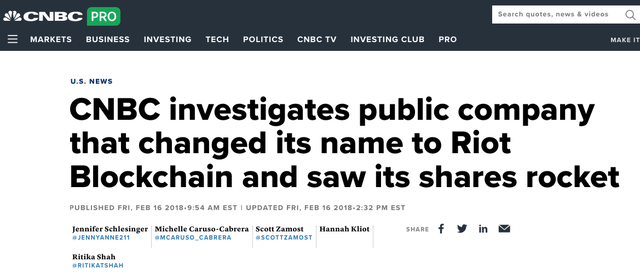

Some may call up that in 2018 Anarchism Blockchain (RIOT) was formerly known as Bioptix prior to its name change and pin into the crypto mining industry. Riot is now considered one of the leaders in the crypto mining space. The crypto economy is still emerging, and the opportunity for a new miner with AMC's cash position to pivot into the industry may still be possible.

AMC is a fundamentally challenged company that has very few ways out of its electric current difficult corporate finance structure. Pivoting to crypto mining would certainly exist a long shot take chances, merely it may exist one of AMC's few pathways out of its electric current decease screw. Companies like Riot have fabricated this pivot piece of work, it may not be too late for AMC to pivot too.

Riot Blockchain successfully pivoted into the crypto mining space (CNBC)

Summary

I believe the current enthusiasm for the trade higher in AMC volition fade, volume will subtract, and the stock cost volition return to its downwards trend. Price targets on the street average virtually $six per share. These targets may be reduced as the looming debt brunt's payments steadily arroyo for 2023. There do not seem to be many good solutions for AMC's predicament.

Until AMC presents the market with any semblance of a feasible business model that can deliver the revenues needed to meet the upcoming debt payments, this stock remains a solid short. Time is ticking confronting AMC'due south chances for survival. Shorting the current price spike for AMC may pay off one time again, as information technology has been doing for months on the failing chart.

Cautionary note: AMC is one of the 2 leading meme stocks, along with GameStop. Volatility can be very high and create an elevated run a risk-reward scenario. Farthermost caution must be exercised in whatever brusk of these meme stocks. Chance direction techniques must be used.

Conclusion

I'chiliad now short AMC shares to a higher place $xxx.

AMC 5-minute chart (IBKR)

This article was written by

Actionable long and curt trading ideas from the broader market

A sometime stockbroker who became licensed in 1986. Later opened a small hedge fund and managed a pocket-size amount of avails during the 1990s tech boom. Our marketplace resource is called Trader's Idea Period that provides actionable ideas for aggressive traders. These trading ideas are both long and short from the broader market place. Nosotros also provide trading ideas / coverage on cryptocurrencies, DeFi, and blockchain technology. Please join Trader'south Thought Catamenia in the Seeking Alpha Marketplace.

Disclosure: I/nosotros have a beneficial short position in the shares of AMC either through stock ownership, options, or other derivatives. I wrote this article myself, and information technology expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business organisation relationship with whatever company whose stock is mentioned in this article.

Source: https://seekingalpha.com/article/4498698-amc-reddit-fans-celebrate-gains-for-now

0 Response to "Ps Ever Giong to Be 30 Again Reddit"

Post a Comment